Changing the Canadian Lending Landscape, One Deal at a Time!

Funding upto 80% LTV Across Ontario

Flexible Mortgage Products for Any Credit

Options for short or longer terms

Best Pricing Upfront, Every time

Efficient Underwriting & Faster Funding

Broker Partner Registration

Access Weekly Rate Updates & Exclusive Offers

Easy Approvals on our Featured Mortgage Products

Mortgage Options built Around Your Clients' Situations

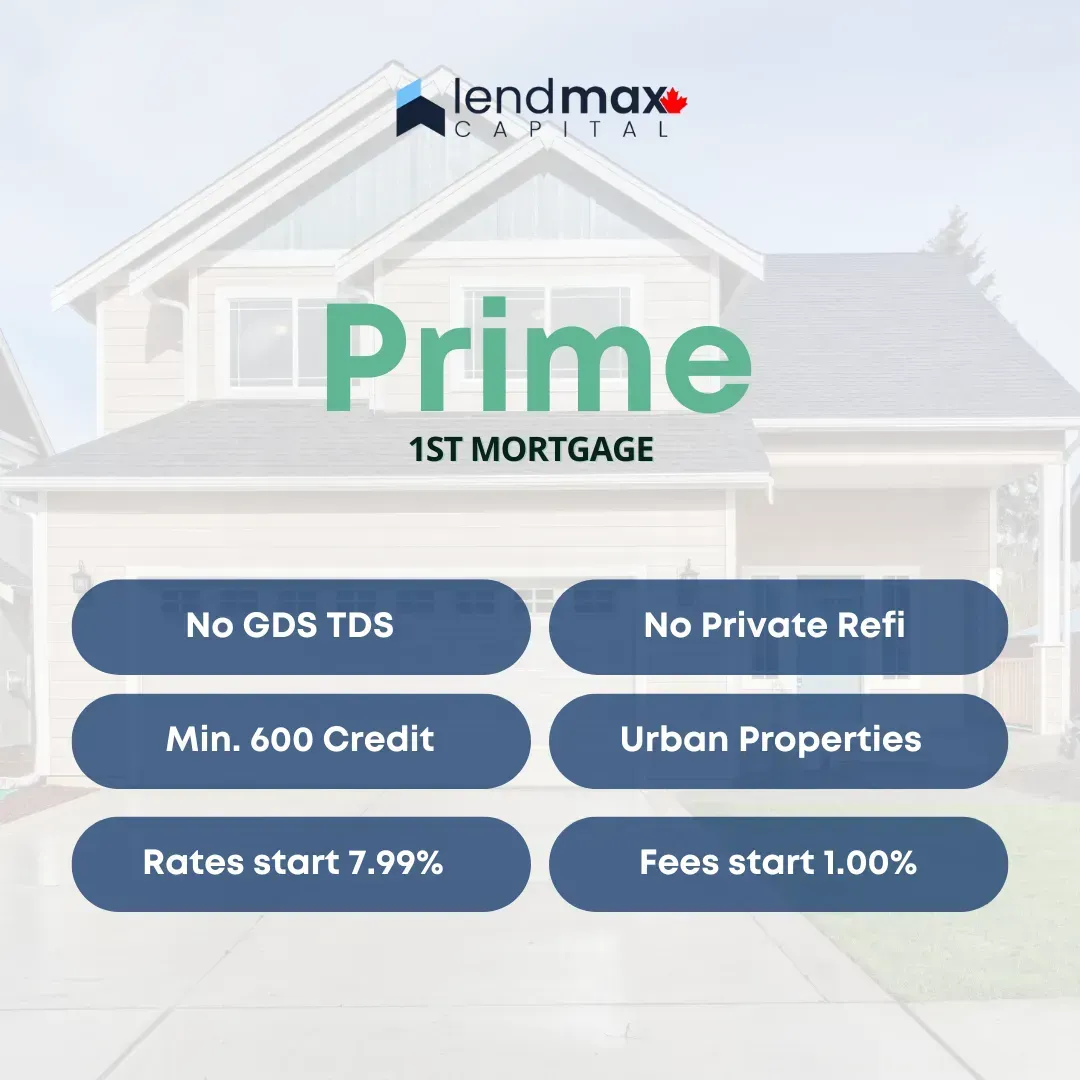

Prime Mortgage

Purchase & Refinance for Urban properties in major city centers where borrowers can demonstrate debt serviceability and a min. 640+ Credit. AB & BC purchases available upto 65% LTV. Private refi upon exception.

Max Mortgage

Purchase & Refinance Ontario wide up to 80% LTV for Urban & Rural properties in cities with minimum 50k population and/or bruised credit where consistent debt servicing is established.

Flex Mortgage

Second mortgages capped to $300,000 with no minimum income or credit requirements. We lend on Urban & Rural properties where borrowers can prove an exit strategy upon maturity.

Solutions, for Almost Every Deal!

Direct Lender Access to 1st and 2nd Mortgage Funds

Up to 80% LTV Ontario-Wide

Towns with populations over 50k

No Max GDS/TDS

No Income Documents Required

No Minimum Credit Score

Up to $1.25M for 1st Mortgages

Up to $300k for 2nd Mortgages

Lend on Appraised Value

Equity-Only Lending

UPTO 80% ONTARIO WIDE

TOWnS >50k POPULATION

NO INCOME DOCUMENTS

NO MIN. CREDIT SCORE

UPTO $1.25M 1st Mortgages

UPTO $300k 2nd MORTGAGES

LEND ON APPRAISED VALUE

EQUITY ONLY LENDING

Deal Pricing Made Easy

Get reviewed faster with a full file submission

Application

A full & complete application is a huge help to us in getting you a quick and competitive pricing. Other properties, liabilities, the borrower's debt servicing ability and overall net worth is required to underwrite the deal for pricing.

Appraisal

We are Equity based lenders. We need an appriasal on every deal upfront to price your deal. An appraisal is more than just a property value... the comparables help us decide on factors like marketability, buyer demand, property condition.

Credit Bureau

Though we don't decline on the basis of credit alone, we do require clarity on the borrower's history with creditors. This helps us determine the rate, our exposure on the deal and can even help us grant an exception on offered LTV.

Quick Access to Funds

Our 2 hour target review for all submissions helps you get an answer on your file faster

Flexible Terms

Open & Closed terms with 3, 6, 9, 12 month Interest only & Amortized options available.

Direct with Underwriters

No middleman. Get feedback directly from Underwriters that approve files

Competitive Pricing

Value pricing for every deal so you get the best rate regardless of income or credit.

Why Mortgage Brokers choose Lendmax?

All we need to price your deal: Application, Appraisal & Credit Report

It's simple - Mortgage brokers want solutions. Lately, there are more and more hoops to jump through in getting an approval. Get your deal priced within minutes of your submission when you provide the application, appraisal &

We aim to demystify the underwriting process with technology and a streamlined process. We also eliminated the need of a business development team, and that means more competitive rates!

We offer upto 80% LTV Across Ontario

We lend on Appraised Value, regardless of the purchase price

Broker Driven, Broker Loyal

Priority Underwriting Service to Mortgage Pros

Email Submissions help us manage our file review better than any electronic submission.

Via Email, we have access to the application, appraisal and credit report all in a single shot helping us underwrite the file faster.

A quick pricing can help you close a deal faster with clients that are looking for an almost instant solution.

To avoid getting shopped on by Your Clients', We recommend every broker to start with a Property Appraisal with the recommended Approved Appraiser List. With a Clear Property Value, its' Marketability, Property Condition and location analytics, Our underwriting team can approve a file in under 20 minutes.

Regulators, Partners, Technology & Associations

Lendmax Capital Mortgage Investment Corp and Lendmax Inc. are

No Compromise, Just Maximize.

Broker

24 Hours

Turn Around

Excellent

Pricing

9.4/10

Solution Convenience

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis imperdiet nisi ac augue elementum porttitor. Etiam vel facilisis nibh. Pellentesque lorem dui, sodales quis eros eu, pharetra auctor felis. Sed ac vehicula eros, ut euismod lacus. Phasellus gravida leo at nunc elementum posuere.

Success in Action

Faster Review, Faster Commitment & Faster Funding

Andre Hollander

I submitted my deal on thursday and they funded on monday. doesnt get better than that. client was extremely happy and got an great rate

Max Armani

I requested a quote for a deal and received a reply in just a couple of hours. I funded that same deal 2 days later. I like their process, its fast and no nonsense. like no bank statements or corporate documents.

Kimberely Beuveau

Happy to see some lenders understand the concept of equity. We funded a deal in pickering at 80% when everyone else declined or low balled. funded pretty quick in about 5 days and rates were reasonable.

Samuel Akendule

Great work guys, thanks for your help in closing so quickly.. highly recommended!!

Aliya Habib

My clients refinance from a pvt 2nd was stuck with no renewal and most lenders declining the deal. I found a good solution here, they used my appraisal and offered a low rate to my client. Definitely use again.

Frequently Asked Questions

Quick Answers to most of your general questions

What provinces are you lending in?

At the moment in ON, we are lending on all our Prime+, Prime, Max and Flex upto 80% LTV (all 1st & 2nd mortgage options). For BC & AB, our first mortgage Prime+ is available upto 65% LTV and

How can I submit my deal?

We accept electronic deal submissions via Filogix & Finmo and via email: [email protected]. Please only submit your deals with a mortgage application, credit report and appraisal for review and pricing. Deals with out appraisals may not receive a prioritized response.

How long does it take to review a file?

Typically we can provide an answer and a pricing on the request within 2 hours after a full review. However we require an appraisal, credit report and application upfront to offer a clear pricing.

What property types do you lend on?

Our specialty is residential, while we do some small commercial for every deal our review requires an analysis of property marketability, days on market, adjusted exposure and exit strategy. With city/town population sizes > 50k or within 15 minutes of a larger city/town we can offer upto 80% LTV on all properties except condominium properties.

What's your max LTV on condos?

For condos, our max at the moment is 65% and we will offer upto 75% on exception where we look for the condo to be a configuration of more than a 1+ Den. We need the condo to be appealing to a larger audience than just investor buyers.

What is your best mortgage product?

We offer 80% LTV on First Mortgage deals that may not qualify with many other lenders on a private refinance or have credit concerns. Since we have no minimum credit requirement, we can be very competitive in a value offering for upto 80% LTV.

Do you charge any fees other than lender/rate?

As a mortgage lender, the only other fee we charge a non-refundable admin fee against each file that has been underwritten, and is ready to be or has been committed. Our admin fee is $1000 for 1st Mortgages and $500 for 2nd mortgages. This fee helps us stay efficient on mortgage requests from serious borrowers and brokers and covers any incidental fees towards legal under a failed transaction instructed to lawyers. There are no hidden fees in our commitment, a schedule A is available for review here.

What's the minimum & maximum mortgage amount?

Our mortgage approvals are offered under our Residential & Commercial regular program and jumbo mortgage program.

Min. Mortgage Amount $25,000 (Regular & Jumbo)

Max. Mortgage Amount $1,000,000 (Regular capped to 80%)

Max. Mortgage Amount $3,000,000 (Jumbo capped to 75%)

Do you offer a single charge mortgage upto 80%?

Our mortgage approvals upto 80% may originate from multiple fund sources with varying risk thresholds or geographical location restrictions. Most 80% approvals are offered as a 1st & 2nd Mortgage Bundles with 2 separate charges.

What is your legal fee?

Lendmax Capital uses a number of approved lawyers on our panel which range between $1,500 to $2,500 plus disbursements & HST priced according to the property value.

What's your renewal fee?

Funded mortgages may be eligible for renewals offered at a renewal rate and fee based on the current market rates and Lendmax Capital current offering. For mortgages that are not eligible for renewal, the borrower will receive a non-renewal notice 90 days prior to the maturity date.

What type of Hold-backs can you apply?

Our typical Hold-back would apply to a Prepaid 12 months, Prepaid 6 months, Property Taxes, Property Repair Condition,

How fast can you fund 1st & 2nd mortgages?

We can instruct a file within 2 hours from the time the File is marked Broker Complete. The funding for 1st mortgages may take upto 5 business days and 2nd mortgages may take upto 2 business days. Please check with the borrowers' lawyers to confirm if they can accommodate an expedited closing. Rush fees apply for mortgages funded under this timeline.

What's your underwriting process?

We rely heavily on our due diligence on the property and the appraisal report when offering an approval or pricing a deal. Credit is relevant however not a deciding factor for our approval. We work with clients under 500 and over 700 beacon scores and the rates vary very little. We look for a clean exit and debt serviceability on every mortgage opportunity.

Lendmax Inc. is a licensed mortgage administrator for LMC MIC. FSRA 13002

IMPORTANT LINKS

LENDMAX INC. COMPLAINTS PROCESS

You can file a complaint with us and we will respond within 5 business days.

Via Mail: Lendmax Inc. 2550 Matheson Blvd. E, #216, Mississauga,

ON L4W 4Z1

Via Email: [email protected]

You can contact FSRA at [email protected], and review their Complaint Guide here

© 2022 Lendmax Capital FSRA Lic. 13002 - All Rights Reserved